We are NOT just another general insurance broker.

Our services are underpinned by the principles of Mindfulness. An authoritative definition of “mindfulness” comes from Dr. Jon Kabat Zinn, who enjoys significant global renown for his work on mindfulness-based stress reduction (MBSR):

“The awareness that arises from paying attention, on purpose, in the present moment and non-judgmentally”

(Kabat-Zinn, in Purser, 2015).

We have taken the following three principles from “ mindfulness ” which we can call (ACC) to apply to our insurance services proposition to our customers: Awareness, Clarity, and Choice .

At Mindful Insurance , we are Aware of the various general insurance products available in the market and also of what can be specially designed to cater to the specific insurance requirements of customers. We explain with Clarity to our clients about the different kinds of cover and explain scenarios that may not have been brought to your attention in the past, enabling them to pick the best Choice . Whether you’re a motor vehicle owner, a homeowner, a business owner, or any other asset owner , these are all factors taken into account when assessing your best possible cover.

We apply the same principles while reviewing our client’s insurance at least annually to ensure their cover is up to date and continues to meet their needs. The same principles inform our very proactive approach towards Claims Management.

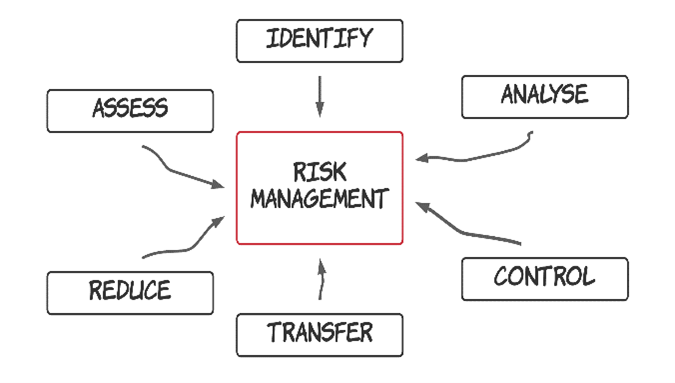

Our Risk Management services are linked to our insurance services as Risk Management involves two main techniques-Risk Control and Risk Transfer. But to do that one has to go through the processes of Risk Identification, Risk Assessment, Risk Analysis, and Risk Reduction. Our Risk Management advice factors in the steps of Risk Management and the Risk Transfer step is taken in due consideration of the relative severity and probability of the risks.

At Mindful Insurance, what drives us is our mission is to deliver an insurance outcome to our clients which will exceed their expectations. Our objective is to get the best possible product at the least possible price. We constantly review our client’s insurance every year to make sure that their cover is up to date and relevant to their needs. We keep a regular tab on all our claims and we keep our clients updated and up to speed our clients on the development of the claim at every stage until the claim is all settled to our client's satisfaction.